Members First Newsletter

Third & Fourth Quarter 2022

Youth Accounts.

At Bethpage, we aim to enrich the lives of our members – of all ages.

It’s essential to build a solid financial foundation from a young age. Our Youth Accounts offer great features to help kids get on the right track.

YOUTH SAVINGS (For ages 0-17)

It’s never too early to start saving.

2.00% APY[1]

On balances from $5.00 to $1,000.00

YOUTH CHECKING (For ages 15-17)

Teens can learn to pay bills, make deposits, and create savings goals.

- No monthly maintenance fees or minimum balance requirements

- FREE ATMs – over 30,000 nationwide[2]

- Free Bethpage Debit Card

Young Adult Accounts.

There is no better time to learn smart money management.

As kids head off to college or enter the workforce, Bethpage has Young Adult Accounts that are designed with them in mind.

YOUNG ADULT SAVINGS (For ages 18-20)

A great way for young adults to manage their money and start gaining financial freedom.

2.00% APY[1]

On balances from $5.00 to $1,000.00

YOUNG ADULT CHECKING (For ages 18-20)

Focus on their future, not fees.

- No monthly maintenance fees or minimum balance requirements

- FREE ATMs – over 30,000 nationwide[2]

- Send money to friends and family with Zelle®[3]

Music to your ears.

Open a Youth or Young Adult Savings Account from July 11 to September 9, 2022, and you’ll receive a FREE Bethpage Bluetooth Speaker!†

To learn more about our Youth and Young Adult Savings Accounts, or to open one today, stop by your local branch or visit lovebethpage.com/music.

[1] Annual Percentage Yield (APY) is effective as of 7/10/2022 and is subject to change, including after account opening, without notice. Balances $5.00 to $1,000.00 will earn 2.00% APY. Balances $1,000.01 to $10,000.00 will earn 2.00% to 0.51% APY range. $10,000.00 balance is an illustrative example for APY computation purposes only. There is no maximum balance for Youth Savings and Young Adult Savings accounts. $5.00 minimum daily balance is required to earn APY. Certain restrictions may apply.

[2] Surcharge free ATMs through the CO-OP ATM Network must show CO-OP ATM logo. ATM transactions performed at ATMs outside of the CO-OP ATM Network may be subject to the ATM owner’s fee.

[3] Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Terms and Conditions apply.

Federally insured by NCUA.

† There is a limit of one (1) Bethpage Bluetooth Speaker per new Youth Savings, Youth Checking, Young Adult Savings or Young Adult Checking account that is opened. If multiple accounts are opened by the same person, only one (1) speaker will be provided. $5.00 minimum balance required to receive speaker and open account. For accounts opened in a branch, the speaker will be provided upon account opening. For accounts opened through the online channel, the speaker will be mailed to the primary account owner’s address within thirty (30) business days of account opening. The value of the speaker is considered interest and subject to reporting on IRS Form 1099-INT. Primary account owner is responsible for any applicable taxes. Offer valid 07/11/2022 through 09/09/2022, or while supplies last. Youth Savings and Young Adult Savings earn 2.00% Annual Percentage Yield (APY) on balances $5.00 to $1,000.00. Balances $1,000.01 to $10,000.00 will earn 2.00% to 0.51% APY range. $10,000.00 balance is an illustrative example for APY computation purposes only. There is no maximum balance for Youth Savings and Young Adult Savings accounts. $5.00 minimum daily balance is required to earn APY. APY is effective as of 7/10/2022 and is subject to change, including after account opening, without notice. Federally insured by NCUA.

Adjustable-Rate Mortgages.

It doesn’t matter if you’re purchasing your first home or your third; Bethpage is here to help turn your home financing dreams into a reality. It’s a huge moment in your life. We want you to have the best experience possible by matching you with the best mortgage product for your needs.

When looking at all of your choices, an Adjustable-Rate Mortgage (ARM) has some unique benefits that could make it the right choice for you. So, what is an ARM, and what does it bring to the table? Let’s take a look.

What is an Adjustable-Rate Mortgage?

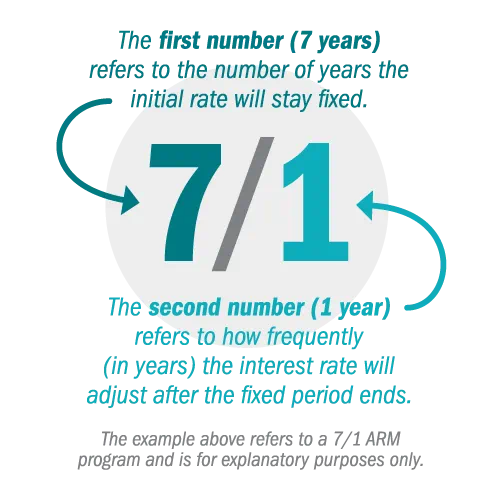

An ARM is a mortgage with a rate and payment that generally starts with a low fixed interest rate for an initial fixed period (typically 3, 5, 7, or 10 years). After the initial fixed period ends, the interest rate will adjust at preset intervals based on market conditions. Typically, an ARM will adjust yearly and can go up or down depending on the rate environment. Adjustable-rate loans are often described by their initial rate period and adjustment interval.

So, what are some of the benefits of this type of loan?

A home can sometimes be more affordable.

Financing your home with an ARM could mean you could fund more than a fixed-rate mortgage would allow because of the reduced initial payments. Is that 2,500 square foot home a better fit for your family’s needs than the 2,000 square foot home? If your income allows, or if you plan to sell your house at a later date, an ARM could potentially allow you to purchase a larger home than you originally planned.

Great if you plan to move and sell your house at a future date.

Is there a chance that you might move again in several years? An ARM can help save you money until that time comes. Suppose you expect to move before the initial fixed period ends. In that case, you may be able to take advantage of a lower initial interest and payment during the initial fixed period without the risk of an interest rate increase.

If rates fall, so can your payments.

Interest rates rise and fall, typically in lockstep with the Federal Reserve Bank’s (the Fed) changes in the rate charged on the money they lend to financial institutions. When the Fed wants to grow the economy, it will reduce its interest rate to make money more affordable.

Your adjustable-rate mortgage interest rate could fall during a time of falling rates - depending on the product – which may lower your monthly payment. However, it is critical to note that your interest rate could also increase during a time of rising rates – which may increase your monthly payment.

Bethpage offers a wide selection of mortgage options. We encourage you to speak with a Mortgage Loan Officer who can help you make the right decision for you.

For today’s rates, visit lovebethpage.com/adjustable or call 855-285-8094.

All loan terms are subject to credit and loan program requirements (applicants may be offered credit at higher rates and other terms). Certain loan programs may not be available to all applicants. Loans above 80% Loan to Value (LTV) requires private mortgage insurance (PMI). Bethpage does not offer residential mortgage loans in Texas. To obtain a loan, membership at Bethpage is required by opening a $5.00 minimum share savings account at or prior to consummation of the loan. Rates, loan programs, terms, and conditions are subject to change without notice. Other restrictions and limitations apply.

NMLS # 449104

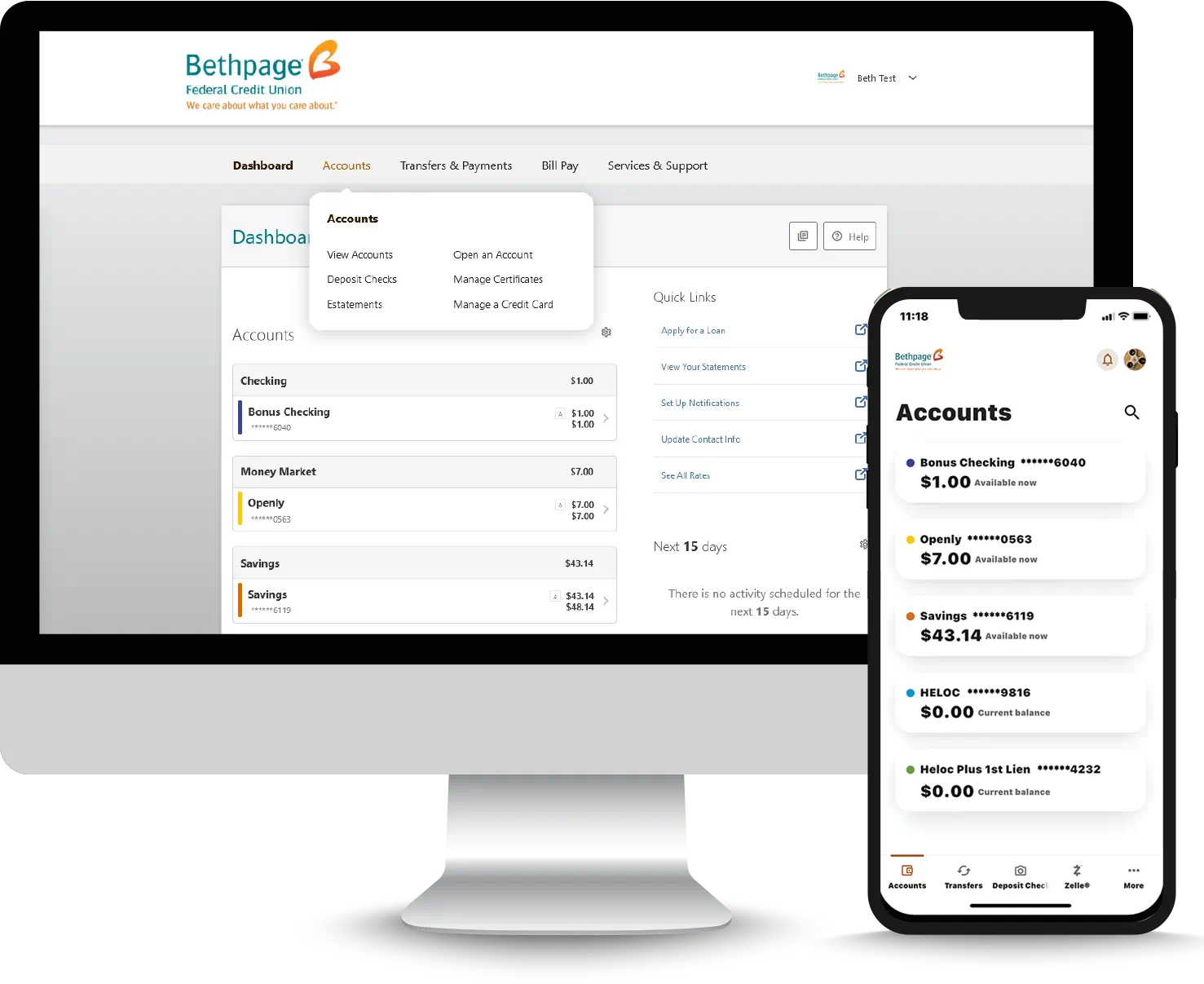

Digital Banking.

Bethpage Digital Banking is getting an upgrade.

We are constantly working to improve your banking experience. We are happy to announce design and navigation updates to Online and Mobile Banking that will make your day-to-day account management even easier. Here’s what you can expect:

MOBILE APP

New account experience.

Our new modern look allows you to swipe your accounts to view quick action buttons and navigate through transaction details much easier. A convenient menu bar at the bottom of your screen will help you access the necessary categories.

Mobile deposit.

The redesigned mobile deposit screen makes depositing a check or viewing your activity more effortless than ever.

DESKTOP EXPERIENCE

Simplified navigation.

Menu items have been relocated to the top of the screen, allowing you to see your options more clearly.

Community spotlight.

Financial Seminar Series.

July, August, and September.

Budgeting 101

Thursday, July 28, 2022, 6:00 PM - 7:00 PM (EST)

Learn ways to manage your money more efficiently. This free webinar will teach you how to create a budget to help you reach your financial goals.

Raising A Money Smart Kid

Session 1: Tuesday, August 9, 2022 , 1:30 PM - 2:30 PM (EST)

Session 2: Thursday, August 18, 2022, 8:30 PM - 9:30 PM (EST)

Earning, spending, and saving money are important lessons children learn very early on in life. In this free webinar, parents will learn practical ways to educate children about financial responsibility that can last a lifetime.

Rebuilding After a Financial Crisis

Thursday, August 25, 2022, 6:00 PM - 7:00 PM (EST)

A job loss, a medical crisis, or other hardship can send a normal financial situation into a tailspin. This free webinar will teach you how to get your finances back on track. Topics include budgeting, repaying debt, rebuilding credit, establishing emergency savings, and replenishing retirement savings.

Understanding Credit

Thursday, September 29, 2022, 6:00 PM - 7:00 PM (EST)

This free webinar covers all aspects of becoming an educated credit consumer. You will learn: how lenders evaluate for credit approval, factors that impact credit qualification, how credit scoring works, and ways money management today affects credit standing tomorrow.

For more information, visit our Upcoming Webinars page.

Bethpage Turkey Drive

Friday, November 18 | 7:30AM – 4:00PM

Bethpage Branch

899 S. Oyster Bay Road, Bethpage, NY 11714

Join us for the 14th Annual Bethpage Turkey Drive benefiting Island Harvest! We will accept frozen turkeys, non-perishable food items, and monetary donations to help supply Thanksgiving meals to families in need. Contributions will remain contactless this year, and our volunteers will safely remove items from your car while you stay inside. Additionally, beginning in November, we will provide an option for online giving! Check in on our social media pages for details.

Bethpage Credit Counseling.[1]

Free financial wellness guidance is just a click away.

Speak to a Certified Credit Union Financial Counselor about the topics that matter to you:

- Improving spending and budgeting outcomes

- Establishing and improving credit

- Debt management

To request an appointment visit lovebethpage.com/creditcounseling.

[1] Our Certified Credit Union Financial Counselors (CCUFCs) provide general educational assistance to Bethpage members about better money management techniques and debt reduction strategies. Bethpage makes no guarantee that such assistance will improve credit, reduce debt, or increase savings. Any advice given should not be construed as legal, tax, or investment advice.

Bethpage Ride is open!

Bethpage Ride provides a convenient, affordable, eco-friendly way to get around in select towns near you. Sponsored by Bethpage and in partnership with PedalShare, bike stations are conveniently located throughout Long Island.

Bike stations can be found in:

- Amityville

- Babylon

- Hampton Bays

- Huntington

- Patchogue

- Riverhead

- ...and more!

How it works:

Download the Bloom Bike app, find available bikes at local docking stations, pay the rental fee, unlock the bike, and ride. Bikes can be returned to any station within the system.

Download the app, and start riding.