Earn 5.40% APY* with a 9-Month Certificate

[*] APY = Annual Percentage Yield. APY is accurate as of and subject to change. APY assumes all dividends remain in the certificate until maturity, and a withdrawal will reduce earnings. Penalties may be imposed for early withdrawal. $50 minimum balance to earn APY and to open account. Fees may reduce earnings.

Earn 5.35% APY* on any balance with a High-Yield Savings Premium account

[*] APY = Annual Percentage Yield. APY is accurate as of and subject to change, including after account opening, without notice. The High-Yield Savings Premium Account is a variable rate tiered account. The variable APY applies by balance tier such that if your daily balance is within a tier, then your entire balance will earn the corresponding APY. APYs and tiers are currently as follows: 5.35% APY for balances $0.00 to $9,999.99; 5.35% APY for balances $10,000 to $99,999.99; 5.35% APY for balances $100,000 to $249,999.99; and 5.35% APY for balances $250,000 and up. The required minimum balance to open account is $0.00. Fees may reduce earnings.

Bethpage Financial Group

Experienced professionals are available to help you on your financial journey. Explore your investing options today!

Money.com

Best Credit Union

Money.com

Best Banks For Students

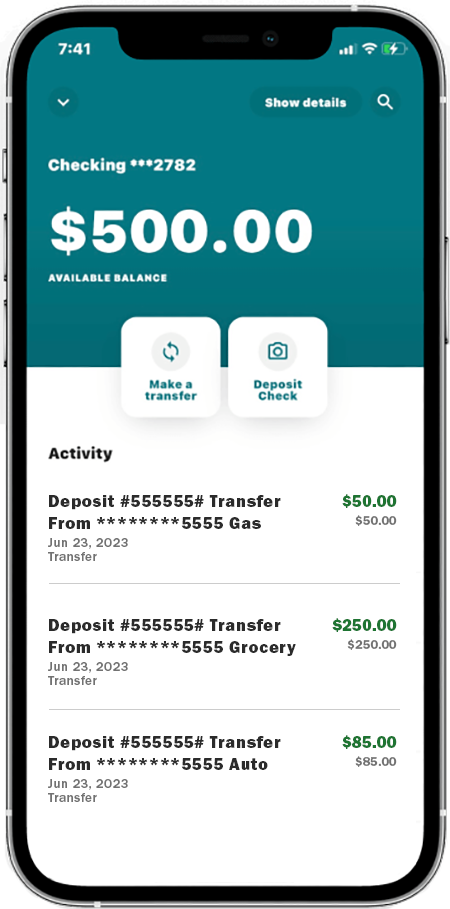

Bethpage Digital Banking

- Access your accounts 24/7

- Deposit checks on the go

- Send money to friends and family with Zelle®

Schedule an appointment

Take advantage of new ways to bank with us including in-person, video, or phone appointments.

Today’s featured rates

[1] APR = Annual Percentage Rate. Rates and terms accurate as of –/–/—- and are subject to change without notice. All offers of credit are subject to credit approval; not all applicants will qualify for the lowest rate and may be offered credit at higher rates and other terms based on creditworthiness. Rates and payment examples assume excellent borrower credit history, a 60-month term and a loan-to value (LTV) of 90% or less. Minimum auto loan amount is $3,750. Rate applies to loan amounts up to a maximum of $100,000.

NEW AUTO LOAN. Loan rates and terms applicable to new vehicles only. New vehicles are defined as the current or previous model year vehicle with less than 5,000 miles. Payment Example: For a term of 60-months based on new car rate of 6.58% APR; estimated monthly payment of $19.60 per $1,000.00 borrowed.

All credit products are subject to credit and collateral approval. Rates, loan programs, terms, and conditions are subject to change without notice. Bethpage does not finance auto purchases from vehicle auction sites. Additional restrictions and limitations may apply. To obtain a loan product from Bethpage, membership is required by opening a minimum $5.00 share savings account prior to loan closing.

Read More

[2] APY = Annual Percentage Yield.

Money Market Account Disclosures:

APY is accurate as of –/–/—- and is subject to change, including after account opening, without notice. The Money Market Account is a variable rate tiered account. The variable APY applies by balance tier such that if your daily balance is within a tier, then your entire balance will earn the corresponding APY. APYs and tiers are currently as follows: 0.10% APY for balances $0.00 to $499.99; 0.35% APY for balances $500 to $49,999.99; 0.60% APY for balances $50,000 to $99,999.99; 0.70% APY for balances $100,000 to $249,999.99; 1.10% APY for balances $250,000 to $499,999.99; and 1.35% APY for balances $500,000 and up. The required minimum balance to open account is $1.00. Fees may reduce earnings.

Student Savings Account Disclosures:

APY = Annual Percentage Yield. APY is accurate as of –/–/—- and subject to change, including after account opening, without notice. The Student Savings account is a variable rate tiered account. Balances $0.00 to $1,000.00 earn 5.00% APY and 4.91% dividend rate. Balances $1,000.01 to $10,000.00 earn 5.00% - 1.39% APY range and 1.00% dividend rate. $10,000.00 balance is an illustrative example for APY computation purposes only. There is no maximum balance for Student Savings accounts. The dividend rate is paid on the portion of the daily balance within each balance tier. The required minimum balance to open account is $5.00. Fees may reduce earnings.

12 Month Certificate Disclosures:

APY is accurate as of –/–/—- and is subject to change without notice. APY assumes all dividends remain in the certificate until maturity, and a withdrawal of dividends will reduce earnings. Penalties may be imposed for early withdrawal. The required minimum balance to open account and earn APY is $50.00. Fees may reduce earnings.

Read More

Bethpage Cares

Bethpage Air Show

Ways we give back to the communities we serve:

Learn more about Bethpage CaresApple, the Apple logo, Apple Pay, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.Android, Google Play, and the Google Play logo are trademarks of Google Inc.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Bethpage Federal Credit Union and Bethpage Financial Group are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Bethpage Financial Group, and may also be employees of Bethpage Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Bethpage Federal Credit Union or Bethpage Financial Group. Securities and insurance offered through LPL or its affiliates are:

Not Credit Union Guaranteed

This website may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult an attorney, tax advisor, or accountant regarding your specific situation. No representations are made as to the accuracy of the information contained herein or any information contained in any link provided herein.

Important Consumer Information:

This site is for informational purposes only and is not intended to be a solicitation or offering of any security and; Representatives of a broker-dealer (“BD”) or investment advisor (“IA”) may only conduct business in a state if the representatives and the BD or IA they represent (a) satisfy the qualification requirements of, and are approved to do business by, the state; or (b) are excluded or exempted from the state’s licensure requirements.

Representatives of a BD or IA are deemed to conduct business in a state to the extent that they provide individualized responses to investor inquiries that involve (a) effecting, or attempting to effect, transactions in securities; or (b) rendering personalized investment advice for compensation.