Members First Newsletter

First & Second Quarter 2023

Set yourself up for success with achievable goals.

Each new year brings renewed hope for self-improvement and financial wellness, usually in the form of resolutions or goals. However, lofty expectations for the year can sometimes be hard to reach.

What’s the key to achieving your goals? Start by thinking about your financial and personal priorities and make a list. Try to focus on a reasonable number to make it possible for you to attain them. Lastly, make sure they are realistic. By setting sensible expectations for yourself, you are more likely to achieve the goal and feel a sense of accomplishment.

Here are some goals that can make 2023 a financial and personal success for you:

CONSOLIDATE DEBT

Managing to pay numerous bills each month such as high-interest credit cards can be stressful. By consolidating your debt into one convenient monthly payment at a fixed rate, you can save yourself the headache and possibly get out of debt faster. Personal loans often have lower interest rates than credit cards and more favorable terms. If you have multiple credit card balances that you are paying high interest rates on, a personal loan could help you: consolidate these into one payment, save money, and get out of debt faster.

START SAVING

Financing your home with an ARM could mean you could fund more than a fixed-rate mortgage would allow because of the reduced initial payments. Is that 2,500 square foot home a better fit for your family’s needs than the 2,000 square foot home? If your income allows, or if you plan to sell your house at a later date, an ARM could potentially allow you to purchase a larger home than you originally planned.

Saving can feel like a daunting task, but it can help establish financial security. Always do your research to find a savings product that meets your needs. If you are looking for a secure and predictable way to save that doesn’t require a large deposit to start, a Money Market or Certificate Account could be a fit. Certificate Accounts are designed to increase your savings dependably over time and offer many terms, from three months all the way up to 60 months, with a fixed dividend rate for the term of the certificate. A Money Market Account helps you save and generally earn higher dividends than a traditional savings account while also providing the flexibility to make withdrawals or deposits.

DO SOMETHING FOR YOURSELF

Goals aren’t always financial; personal goals can be equally as rewarding. Maybe you want to complete a home improvement project, go on a family vacation, or focus on your higher education. Start by creating a designated day or time to stick to the task. Then, determine what funds you’ll need. If the cost is significant, it may require financing. For homeowners with equity in their home, a Home Equity Line of Credit (HELOC) could be a great financing option. A HELOC is an open line of credit based on the equity in your home. It provides you with the flexibility to use the funds when you want and how you want, and you only pay interest (during the draw period) on what you use. [1]

SET A BUDGET

If you use a HELOC to fund a larger expense such as one of the above examples, you’ll need to calculate your expenses and compare them to your income to ensure that you will be able to make your monthly payments. This can be difficult to calculate with a variable-rate HELOC. If you are looking for predictable payments, you could convert some or all of your variable-rate HELOC to a fixed-rate loan option (FRLO) [2]. With a FRLO, you’re protected from rising rates and have the security of fixed monthly payments. This will help you create a feasible budget.

All loan terms are subject to credit and loan program requirements. Loan programs, terms, and conditions are subject to change without notice. Other restrictions and limitations may apply. Hazard insurance is required on all loans secured by real property (flood insurance may also be required where applicable). Bethpage does not currently offer residential mortgage loans nor HELOCs in Texas. All credit products require membership at or prior to consummation.

[1] Interest-only payments apply to variable rate line in use only and is not applicable to any Fixed-Rate Loan Option.

The APR is variable based on the U.S. Prime Rate as published in the Wall Street Journal, plus a margin (if applicable) and will vary with changes in the Prime Rate. The APR is subject to increase after consummation. The Prime Rate as of 12/15/2022 = 7.50%. The variable APRs as of 12/15/2022 ranges from 7.50% to 8.50% based on credit history, combined loan to value (CLTV), the amount advanced, and if automatic transfers from a Bethpage personal savings or checking account is set up. The minimum floor APR is 3.25%. HELOCs are variable rate products and rates may not exceed the maximum legal limit for Federal credit unions (currently 18%).

Closing costs for the first $500,000 will be paid by Bethpage, but must be repaid by the borrower(s) if the HELOC is closed within the first 36 months of account opening. These fees generally range between $500.00 and $15,000.00 depending on the line amount, property value, location, and/or property type. Line amounts over $500,000 may be available on a case-by-case basis to qualified applicants, are not eligible for the discounted introductory rate at any time, and the borrower(s) will be responsible for mortgage related taxes and title insurance costs on the line amount over $500,000 (up to the approved credit limit). The total third party fees generally range between $500.00 and $60,000.00 depending on the line amount, property value, location, and/or property type. Property insurance (including flood insurance, if applicable) is required.

[2] A Fixed-Rate Loan Option (FRLO) allows you to convert an outstanding variable rate HELOC balance(s) to a fixed rate loan(s), which results in fixed monthly principal and interest payments at a fixed interest rate. A FRLO is optional and is available at the time of disbursement (account opening), or during the 10-year draw period. Borrowers may only have a maximum of three (3) FRLOs open at any one time. The minimum amount for each FRLO is $10,000. The minimum loan term is 5-years, and the maximum term cannot exceed the account maturity date. If you choose to convert any portion of your balance to a FRLO, the APR will be the U.S. Prime Rate as published in the Wall Street Journal that is in effect at the date of conversion, plus a margin. The margin applied will be based on your credit history and CLTV ratio at the time of application and the term selected for the FRLO. Rates for a FRLO are typically higher than the variable rates on the HELOC account. Bethpage NMLS ID: 449104.

Fraud prevention tips.

Welcome to 2023! As the holiday season comes to an end, it’s still important to be aware of cybercriminals getting a hold of your personal information. Here are a few tips to make sure you do not fall victim to fraud:

PROTECT YOUR PERSONAL DATA

Beware of Malware

Malware is malicious software that is used to gain access to a computer system to steal data. Cybercriminals will try to scam people by sending a link or attachment in an email, text message, or social media post. Never open an attachment or link unless you have confirmed it’s safe.

Stay Aware of Updating Your Software

If a software update pops up on your screen, it’s important to act promptly to lower security vulnerabilities, such as data breaches, cyberattacks, and identity theft. Try configuring your devices to update software automatically so you don’t have to remember to do it.

Enable Multi-Factor Authentication

This requires anyone logging into a device to enter a number that the authenticator sends to your phone. The 6-digit number changes every 30 seconds, so even if the hacker knew the number you previously used, they would still be locked out.

Longer and Stronger Passwords

Use passwords that are long and unique with a combination of numbers, symbols, and both upper and lower-case letters.

Keep It Backed Up

Always protect your data by backing it up to an external drive or a cloud service.

RECOGNIZE SCAMMING FORMATS

Secure Your Inbox

Spam filters can eliminate most suspicious messages, but it’s imperative to filter out the rest. Carefully inspect the sender’s email address. Scammers often create email addresses that appear legitimate but are slightly misspelled.

Text Messages

A text asking you to click a link because your account has been compromised shouts “red flag.” Think before you click because this could give the cybercriminal access to your private information.

Phone Calls

Phone scammers are not only using automated systems, but they could connect victims to a live person who impersonates a legitimate company to make you believe that the call is real. Don’t pay up, just hang up.

QR Codes

Scammers use QR codes to direct people to malicious websites to install malware on devices and steal login information. If you are unsure if the code is safe, it’s best to go directly to the site through a web browser.

Web Browsers

Don’t fall for the small notifications displayed on your device, as hackers can use this to install malware. Block all browser notifications to avoid the risk.

If you think you have been a victim of fraud, stop by your local branch or call us at 800-768-2020.

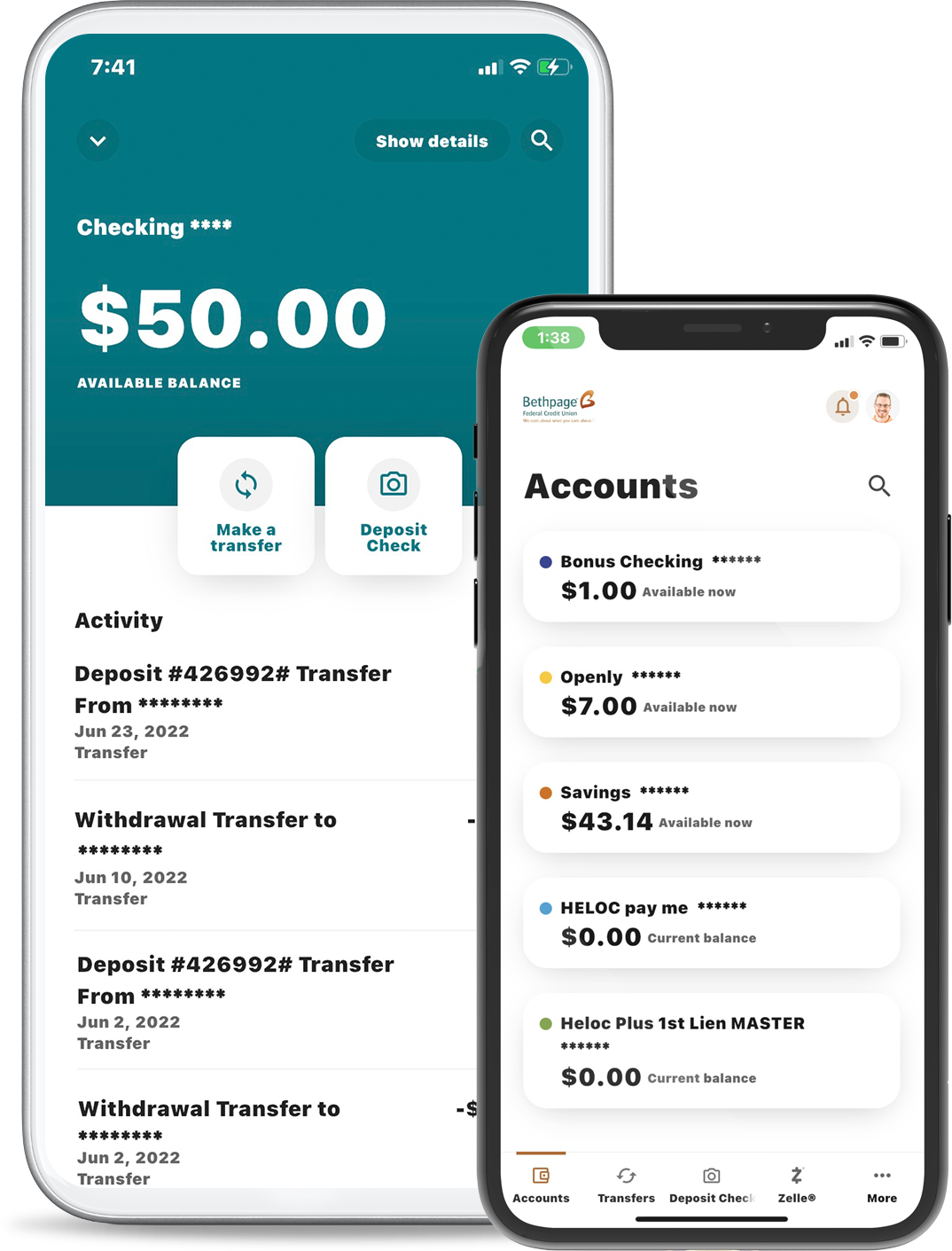

Bethpage brings better Digital Banking!

As we continuously work to improve your banking experience, we are happy to announce new design and navigation updates to our Mobile Banking. The upgraded mobile app will make it easier to:

- Navigate through transaction details

- Track your accounts via alerts and balance notifications

- Swipe through your accounts to view quick action buttons

Did you know?

With Bethpage mobile banking, you get more convenience and flexibility to bank the way you want. Our mobile app lets you have all these features at your fingertips:

- Transfer between accounts and set up automatic payments

- Secure sign-in with face or touch ID

- Send money to family and friends using Zelle®

- Check balances, view statements, and deposit checks without visiting a branch

- Link to your digital wallet for a secure and convenient way to pay online or in stores

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Visit the App Store or Google Play to download the Bethpage Mobile Banking app to stay connected to all your Bethpage accounts. It’s quick, easy, and secure.

Apple, the Apple logo, Apple Pay, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Android, Google Play, and the Google Play logo are trademarks of Google Inc.

Employee spotlight.

Edward Chiddo

Commercial Underwriter

8 years at Bethpage

How did you first learn about Bethpage?

I’ve known about Bethpage my entire life. My parents had been members since my mother and grandfather worked at Grumman. I opened my first Bethpage account when I was a teenager and have been a member ever since.

What is your role at Bethpage? How do you Enrich Lives?

As a Commercial Underwriter, I prepare detailed credit analysis on commercial credits. I underwrite new commercial originations and determine whether we should proceed with approving or denying the loan request. Recently, I had the opportunity to underwrite our largest commercial loan to date – a $105,000,000 multi-family apartment building in Long Island City, NY.

Three words that describe Bethpage?

Caring, proactive, and innovative.

Board nominations.

ANNE NIKAS-BRIGIS

When Anne volunteered as a young teenager at the Flushing YMCA, her local hometown Y, she never imagined it would be the beginning of her life’s work. Upon graduation from college, she embarked on a successful career on Madison Avenue, but Anne’s love and passion of helping others brought her back to the Flushing YMCA. After seven years at the Flushing Y, she accepted a position as Associate Executive Director of the newly built Great South Bay Branch. It was clear Anne had a great vision for her YMCA and was appointed Executive Director. Excitement, accomplishment and movement characterized those first few years. She continued to rise through the ranks and achieved her dream of becoming President & CEO of the YMCA of Long Island in 2012.

Anne’s priority has always been to serve the Long Island communities with a spectrum of programs that center on the YMCA core values of caring, honesty, respect and responsibility. A proven YMCA organizational leader with more than 37 years of YMCA executive management experience, Anne is an outstanding communicator who enjoys engaging community leaders and volunteers to advance our mission. Under her dynamic leadership, our Y has not only transformed lives, but has made a lasting impact. Hope, dedication, drive, transformation, passion, faith, are just a few words to describe who we are, what we do and what we strive to mean to our members, staff, volunteers and the community.

Anne has been recognized for her exemplary leadership. She is most proud of the awards received from the AYP and Leadership Achievement in 1998 and again in 2004. Anne was awarded the “Save a Child” award from the Rotary Gift of Life in 1993 and LIBN “Top 50 Women of 2007.” In 2010, she was unanimously selected for the Great South Bay Boulton Center for the Performing Arts “Ambassador of the Arts” and in 2015, received the Achiever’s Award from the Long Island Center for Business and Professional Women. In 2016, she was listed in LIBN “Who’s Who of Professional Women” and the ACIT Distinguished Leadership Award for Outstanding Community Service.

Anne is Vice Chair for Bethpage Federal Credit Union. She was Past Chair of the New York State Alliance of Ys; Past Chair of the Y Employee Benefits Management committee; in addition to a number of other Y-USA Committees including Y Champions for Child Protection.

Anne lives happily with her husband Anthony, in Sea Cliff; and her daughter, Joy is married to John Paradise and lives in Northport; and her son Nicholas resides in NYC.

PETER ELIOPOULOS

As Managing Partner of Helios Innovation Group, based in New York, Peter Eliopoulos focuses on strategy, insights-driven growth, marketing sales and organizational alignment. The firm is engaged in innovation and team-based problem solving to collaboratively produce tangible results- driving the bottom line and firm mission. Throughout his career, Eliopoulos has successfully led teams across the financial services sector, provided strategic consulting services and created capabilities around data analytics and digital marketing platforms, driving tangible impact and value. Prior to Helios Innovation Group, Eliopoulos spent 13 years at M&T Bank Corporation, Wilmington Trust, where he served as Chief Marketing and Communications Officer. During his tenure, Eliopoulos transformed M&T Bank and the Wilmington Trust marketing divisions, repositioning and relaunching the two brands.

Eliopoulos currently serves on the boards of the Buffalo Philharmonic Orchestra, Kleinhans Music Hall, Boston University’s Tanglewood Institute, and the Addison Gallery of American Art. Eliopoulos received his Master’s in Business Administration from New York University and his Bachelor of Arts in Comparative Literature from Brown University.

PHIL GANDOLFO

Phil Gandolfo, CPA, a Farmingdale resident, is a retired Senior Vice President at Emblem Health Plans and former Executive Vice President, Chief Operating Officer and Chief Financial Officer of Vytra Health Plans. Mr. Gandolfo has been a Bethpage member since 1977. In 1991, the Board of Directors appointed him to the Supervisory Committee, and he joined the Board in 1994. He is a former Chair, Vice Chair, Secretary and Treasurer of the Board.

GREGG NEVOLA

Gregg Nevola is the Vice President and Chief Wellbeing Officer for Northwell Health. The organization has an annual operating budget of more than $13.5 billion and a workforce comprised of more than 80,000 employees, making it the largest private employer in New York State. Northwell has been awarded the 2021 and 2022 Healthiest 100 award as well as one of Fortune’s Best Places to Work in 2021 and 2022. The health system is comprised of 23 hospitals, several long-term care facilities, an internationally recognized medical research institute, New York State’s first new allopathic medical school in more than 40 years, the Donald and Barbara Zucker School of Medicine at Hofstra/Northwell and over 4,500 employed physicians.

Gregg oversees all of Total Wellbeing, which is comprised of multiple departments including Benefits (Operations & Strategy), Joint Ventures, EAP (Employee Assistance Program), Wellness and EHS (Employee Health Services). Gregg is responsible for overseeing the strategy, operations and execution of all Northwell’s rewards programs, which includes $800 million in medical benefits and retirement programs with over $10 billion in assets.

Gregg previously worked for Adecco, a global HR solutions firm with over 30,000 employees around the world. There he spent more than 12 years overseeing benefits management and administration, including retirement, incentive plan design and administration, HRIS, payroll and other key HR functions.

He holds a Master of Business Administration degree in Finance from Hofstra University and a Bachelor of Science degree in Economics from Binghamton University. He is also a Certified Employee Benefits Specialist. Additionally, he is a Board Member for Bethpage Federal Credit Union and is an Associate Trustee of the 1199 National Benefit and Pension Fund.

JIMMIE OWENS

Jimmie Owens brings deep-rooted financial and security experience to Bethpage’s Board of Directors. Having spent most of his career in the highly regulated world of financial services, Owens has successfully integrated this with his deep-rooted expertise in operations and technology to improve the risk management and governance processes of high-powered organizations. At DXC Technology, a global company based in Virginia, Owens has developed and implemented a vulnerability management program to gain 90% risk reduction, achieved 99% compliance across 180,000 employees for information security required training, and implemented an enterprise security enhancement program.

In his current role as Global Chief Information Security Officer, Owens is responsible for enhancing identity and access management processes to improve end-user experience and the automation of access control to information systems. Prior to DXC Technology, Owens served as a Vice President, Information Security and Chief Information Security Officer at Paychex where he developed a strategic roadmap and gained business support to improve the information security program.

As Senior Vice President and Chief Information Security Officer at Pentagon Federal Credit Union, Owens headed up asset protection and the financial institution’s global information security program, ensuring the security and integrity of member data, managing all strategic company information. At Navy Federal Credit Union, as the Assistant Vice President Information Security and Deputy Chief Information Security Officer, Jimmie Owens developed a strategic roadmap to significantly improve the credit union’s information security program. Owens earned his Bachelor of Science in Information Systems Management from the University of Maryland University College.

Community spotlight.

Free virtual tax preparation.

The 20th annual Bethpage Volunteer Income Tax Assistance (VITA) Program is here!

2023 VITA Program

Wednesday, February 1 - Thursday, April 6, 2023.

The Volunteer Income Tax Assistance (VITA) program offers free tax help for individuals and families with low-to-moderate income (generally $60,000 or less), persons with disabilities, and limited English-speaking taxpayers who need assistance preparing their own tax returns. IRS VITA/TCE certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

For more information, please visit lovebethpage.com/vita, call 516-349-4288 or email community@bethpagefcu.com.

The IRS manages the VITA/TCE program. The program is operated and staffed by volunteers who are not tax professionals.

Empowering our youth.

Youth Empowerment Grants.

Is your child looking to effect change? Do you know of a youth group (e.g., after-school program, community group, sports team, school club) with big ideas that needs financial support? Bethpage wants to empower young individuals to come together and become more involved by linking their passions with the needs of local communities.

Early in 2020, we launched our Difference Makers student volunteer program, focused on improving the excellence of life in the communities we serve. Designed to inspire young individuals — 13 years old through 21 years old—who are looking to make a difference in their local communities, with grants ranging from $250 – $5,000.

These funds can be used for special projects, like planting a community garden, painting a mural in a school or community space, and organizing a beach cleanup. Or, the money may be put toward starting a peer mentor program or anti-bullying campaign at a school. We welcome and encourage creativity in the application process. We will ask for a business plan that includes a project summary, budget, timeline, and the community impact it will provide.

Every project will be assigned a Bethpage Mentor to oversee and support the initiative by answering any questions. We can’t wait to help make our community an even better place to live! If you know an ambitious child or youth group looking for financial support to bring their big idea to life, visit lovebethpage.com/differencemakers for more information or to apply for a grant!

14th Annual Bethpage Turkey Drive.

We would like to extend our gratitude to all who donated to our 14th Annual Bethpage Turkey Drive benefiting Island Harvest and helping those facing food insecurity on Long Island.

With your generosity, we collected:

- 3,739 turkeys

- Over 31,000 pounds of food

- Over $33,000 in donations

Thank you again for your support!