Portable ‘skimmer’ devices on ATMs or card terminals are installed illegally and typically not visible to consumers. The device captures personal information from the magnetic stripe of the card, including the cardholder’s name, card number, expiration date, CVV, and billing zip code.

Fuel Pump Skimming

- Not visible to the customer and are usually attached to the internal wiring of the machine.

- The device stores data to be downloaded later or wirelessly transferred.

Tips When Using a Fuel Pump

- Run your debit card as a credit card so you do not need to enter your PIN.

- If you must enter your PIN, be sure to cover the keypad when entering it.

- Consider paying inside with the attendant, not outside at the pump.

- Take notice if there is a tamper sticker that has been broken and notify the attendant.

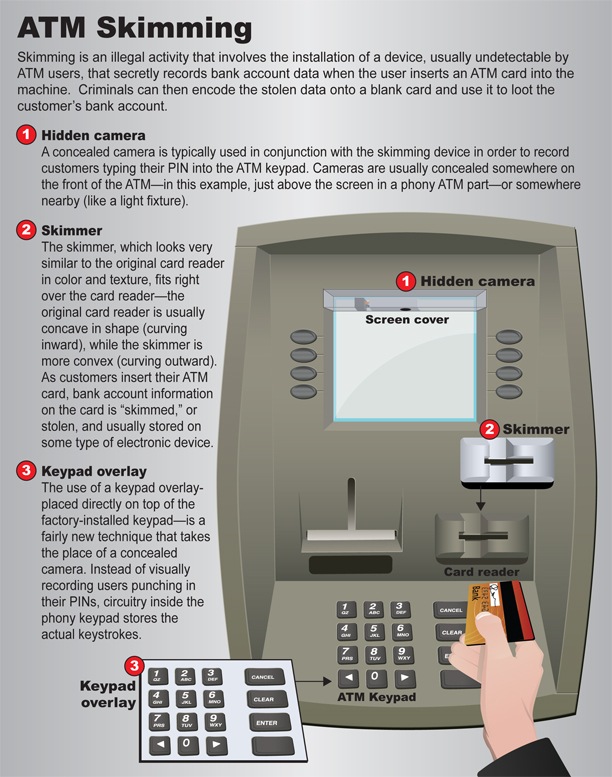

ATM Skimming

- Usually fit over the original card reader, are inserted in the card reader, placed in the terminal, or situated along exposed cables.

- Pinhole cameras installed on ATMs can record a customer entering their PIN. In some cases, keypad overlays are used instead of pinhole cameras to record PINs. Keypad overlays record a customer’s keystrokes.

Tips When Using an ATM

- Inspect ATMs, Point of Sale (POS) terminals, and other card readers before using. Look for anything loose, crooked, damaged, or scratched.

- Don’t use any card reader if you notice anything unusual.

- Cover the keypad when entering your PIN to prevent cameras from recording your entry.

- Use ATMs in a well-lit or indoor location, which are less vulnerable targets.

- Be alert for skimming devices in tourist areas, which are popular targets.

- Use debit and credit cards with chip technology.

- Contact your financial institution if the ATM doesn’t return your card after you end or cancel a transaction.

Bethpage offers 24/7 fraud monitoring on your debit and ATM cards based on current fraud trends. Be sure to monitor your accounts regularly and report any suspicious or unauthorized transactions immediately by calling 800-628-7070.

- Categories: