Fixed-Rate Loan Option (HELOC)

Here is an example of how a Fixed-Rate Loan Option works within your

Home Equity Line of Credit:

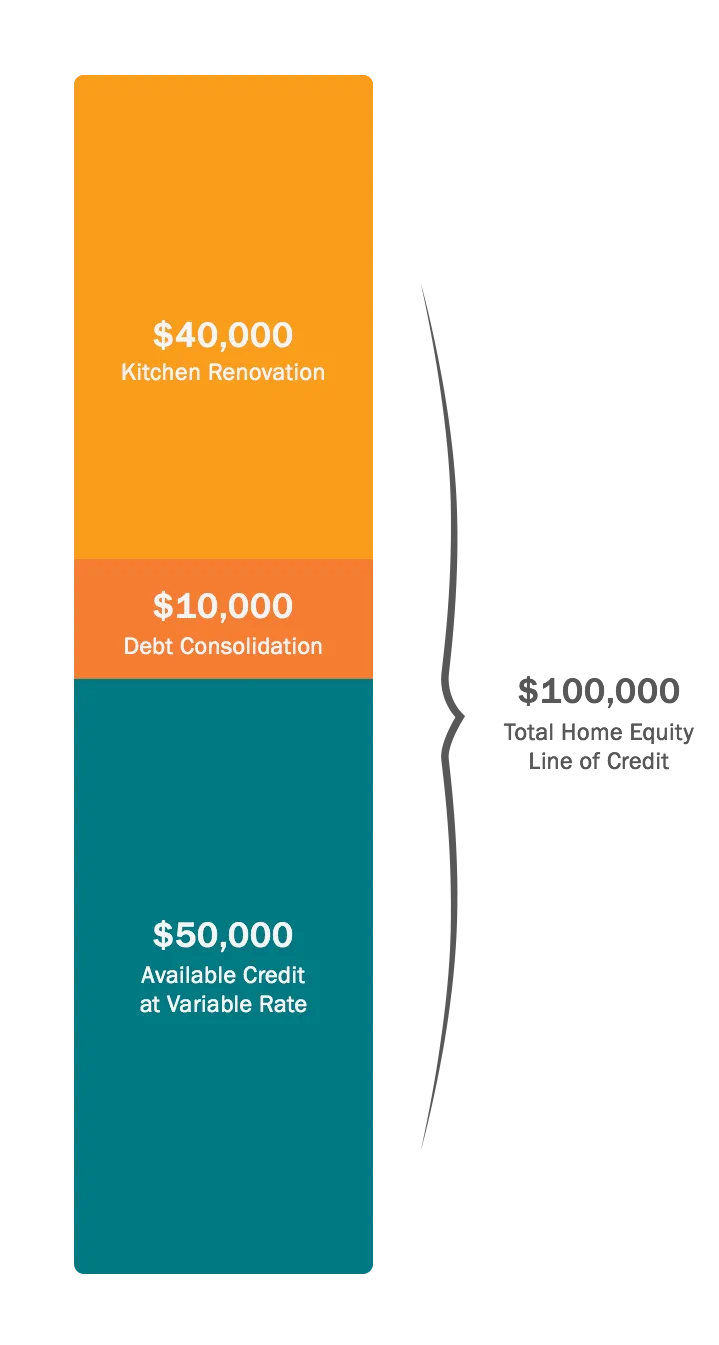

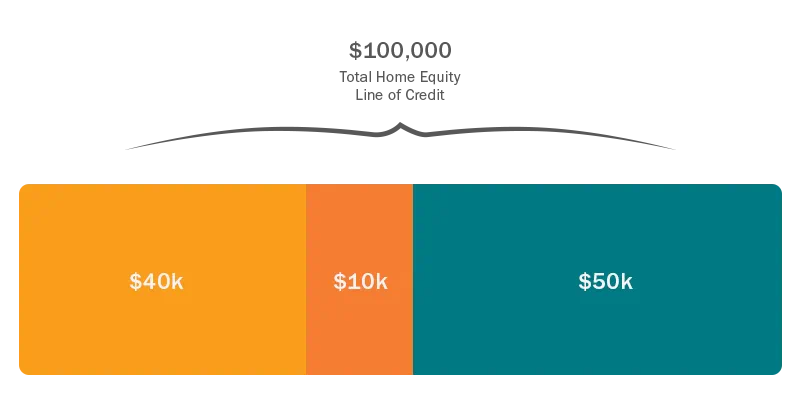

You open a $100,000 Home Equity Line of Credit with Bethpage.

You want to use $40,000 to start a kitchen renovation.

Using the Fixed-Rate Loan Option in your HELOC, you can lock that $40,000 in at a fixed rate for a fixed term, making your monthly payments stable and predictable.

The remaining $60,000 is still available for use with other expenses.

You might then decide to consolidate other bills, totaling $10,000. You can select a second Fixed-Rate Loan Option, locking in another fixed rate for another fixed term.

As you begin to pay back the principal on the $50,000 in your Fixed-Rate Loans, the amount available from your original $100,000 HELOC begins to grow again – there for you to use.

Whether you use it at closing or some time down the road, the Fixed-Rate Loan Option adds flexibility to your Bethpage Home Equity Line of Credit.